Rowan County Property Tax Listing

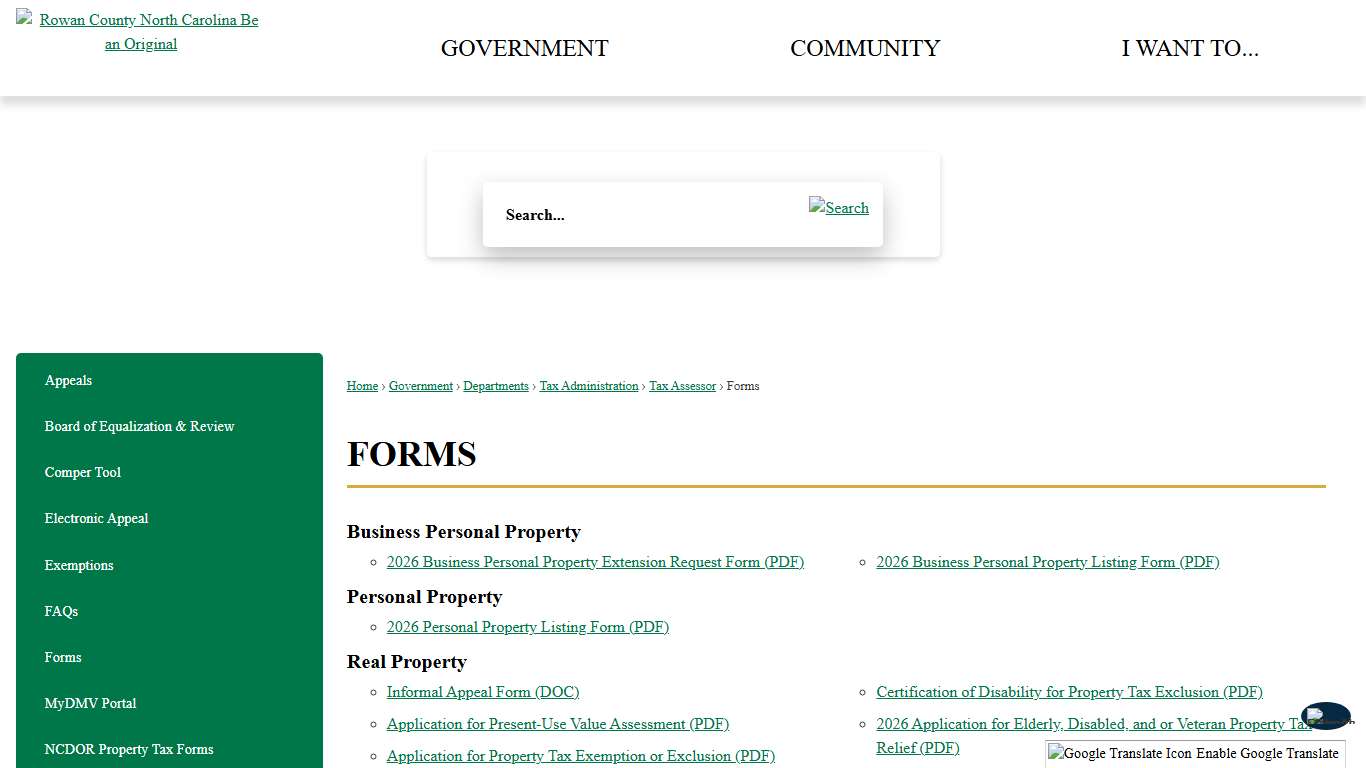

Forms | Rowan County

View the various forms, applications and documents regarding the work of the County Assessor.

https://www.rowancountync.gov/483/Forms

Tax Administration | Rowan County

Electronic Online Listing will not be offered for 2025. We are currently creating a new Electronic Online Listing process that should be available for the 2026 Listing season. Please call 704-216-8558 if you have any questions.

https://www.rowancountync.gov/1139/Tax-Administration

2026 Business Personal Property Listing Form | NCDOR

The 2026 business personal property listing form and instructions is for any individual(s) or business(es) owning or possessing personal property used or connected with a business or other income producing purpose on January 1. The Raleigh Service Center has moved to its new location on Highwoods Blvd following regular business hours.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-forms/2026-business-personal-property-listing-form/2026-business-personal-property-listing-form

Business Personal Property Extension Request

The extension request form must be submitted to our oƯice no later than January 31, 2026. Approved extensions are granted through April 15, 2026. Tax Year: ...

https://www.rowancountync.gov/DocumentCenter/View/48702/2026-Business-Personal-Property-Extension-Request-Form-PDFThe 2025 delinquent tax list will be updated on a ...

Rowan County Tax Sale date is scheduled for Monday,. September 30th 2026, at 10:00 am. Please read the following as these rules impact the sale ...

https://rowancountyclerk.ky.gov/rowan-county-2025-tax-sale-updated-10-22-25/Property Taxes - Rowan Country Sheriff's Department

The Rowan County, KY Sheriff’s Department is now accepting Visa, MasterCard, American Express, Discover credit cards for tax payments. A convenience fee of 2.49% for payments over $60.00 or a flat fee of $1.50 for payments under $60.00, charged by a third party vendor, will be added to all credit transactions.

https://rowancountysheriff.net/property-taxes/

To determine if your... - Rowan County Clerk's Office | Facebook

•Select “Delinquent property taxes.” •Select “click here for 2014-2022 partial delinquent taxes that have been released to be purchased.” Or the 2024 Delinquent Property Tax Bills. Delinquent property taxes can be paid at the Clerks office or over the phone. Monday-Friday 8 AM to 4 PM.

https://www.facebook.com/RowanCountyClerksOffice/posts/to-determine-if-your-property-is-included-on-this-list-please-visit-rowancountyc/1088514940129685/

Rowan County Open Data Portal

Stay up to date on changes to the search catalog through the available feeds. Add RSS (guide) to an aggregator such as Inoreader or Feedly and see daily changes to this site's content. Use the DCAT feeds to federate this site's content with external catalogs like data.gov or data.europa.eu.

https://gisdata-rowancountync.opendata.arcgis.com/search?tags=Property

Cabarrus property tax payments due soon; new listing period opens Cabarrus County

Cabarrus property tax payments due soon; new listing period opens Published on December 30, 2025 As the new year approaches, Cabarrus officials are reminding residents that January 5, 2026, is the last day to pay this year’s Cabarrus County and municipal real estate and personal property tax bills without interest.

https://www.cabarruscounty.us/News/Cabarrus-property-tax-payments-due-soon-new-listing-period-opens

Property Taxes | Norfolk County

Sign up Virtual County Hall Manage your accounts online Sign up for Virtual County Hall Create an account on Norfolk County's Virtual County Hall (VCH) website to manage your property tax account(s). Property Taxes Tax Collection Policy Norfolk's Tax Collection Policy establishes efficient and effective methods for collecting property taxes utilizing various procedures legislated by the Municipal Act, 2001, County by-laws, and policies.

https://www.norfolkcounty.ca/council-administration-and-government/property-taxes/

Payments | Rowan County

Electronic Online Listing will not be offered for 2025. We are currently creating a new Electronic Online Listing process that should be available for the 2026 Listing season. Please call 704-216-8558 if you have any questions. Pay Online Payments can be made online.

https://www.rowancountync.gov/225/Payments

2026 Rowan County County Sales Tax Rate - Avalara

Rowan County sales tax details The minimum combined 2026 sales tax rate for Rowan County, North Carolina is 7.0%. This is the total of state, county, and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The Rowan County sales tax rate is 2.25%.

https://www.avalara.com/taxrates/en/state-rates/north-carolina/counties/rowan-county.html

Delinquent Taxes - Rowan County Clerk

Delinquent Taxes Delinquent Property Tax Timeline Each year the citizens of Rowan County pay their annual property tax to the county. In the event, an individual fails to pay by the deadline (April 16), the property tax bill will be transferred to the Rowan County Clerk’s Office, and penalty fees will be assessed.

https://rowancountyclerk.ky.gov/delinquent-taxes/

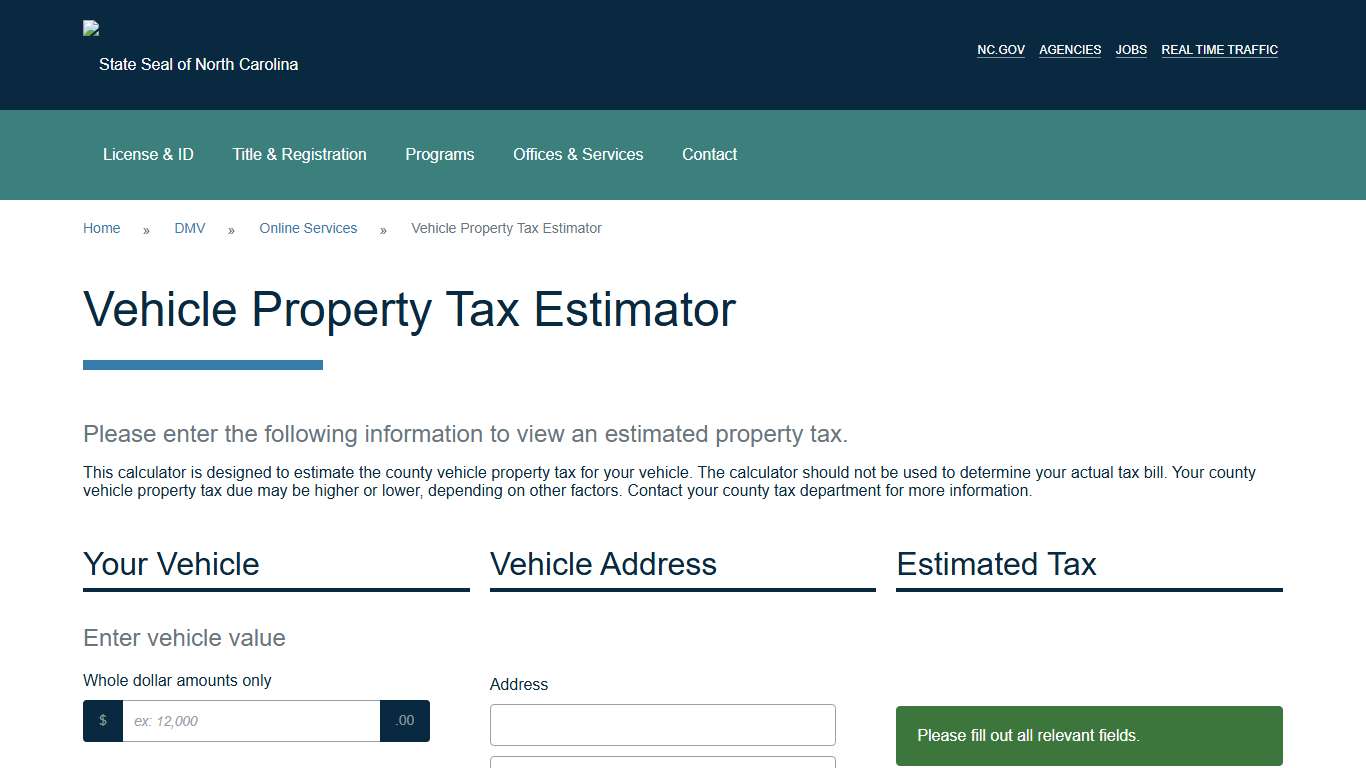

North Carolina Vehicle Property Tax Estimator

Please enter the following information to view an estimated property tax. This calculator is designed to estimate the county vehicle property tax for your vehicle. The calculator should not be used to determine your actual tax bill. Your county vehicle property tax due may be higher or lower, depending on other factors. Contact your county tax department for more information.

https://edmv.ncdot.gov/TaxEstimator

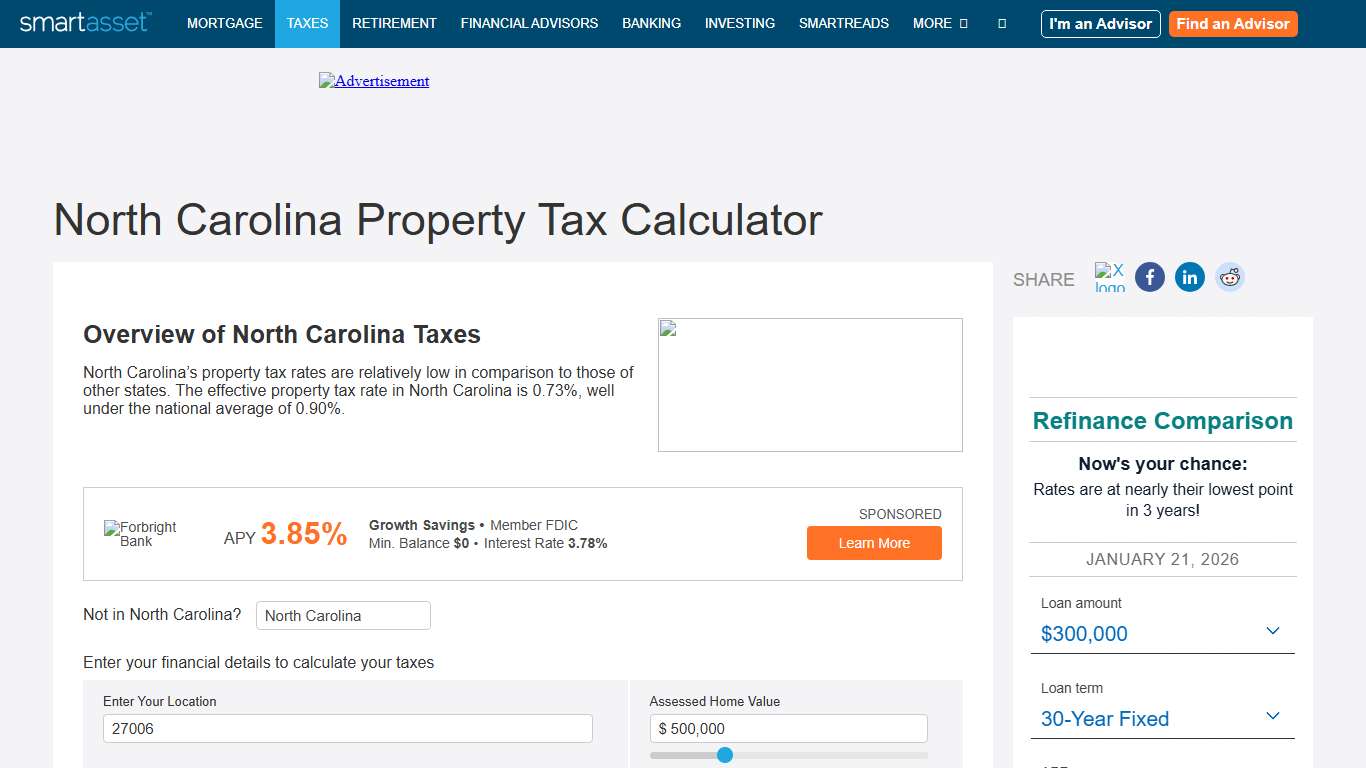

North Carolina Property Tax Calculator - SmartAsset

Overview of North Carolina Taxes North Carolina’s property tax rates are relatively low in comparison to those of other states. The effective property tax rate in North Carolina is 0.73%, well under the national average of 0.90%. - About This Answer To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

https://smartasset.com/taxes/north-carolina-property-tax-calculator